“Stay One Step Ahead: Understanding the Risks of Credit Card Generators”

In today’s digital age, convenience and speed often drive the way we conduct financial transactions. Credit cards have become an integral part of our lives, offering us a convenient way to make purchases online and in-person. However, with the rise of online transactions, there has also been a surge in cybercrime and fraudulent activities. One such threat is the use of credit card generators, tools that produce seemingly valid credit card numbers for unauthorized use. Understanding the risks associated with credit card generators is crucial for both consumers and businesses to stay one step ahead of cybercriminals.

What are Credit Card Generators?

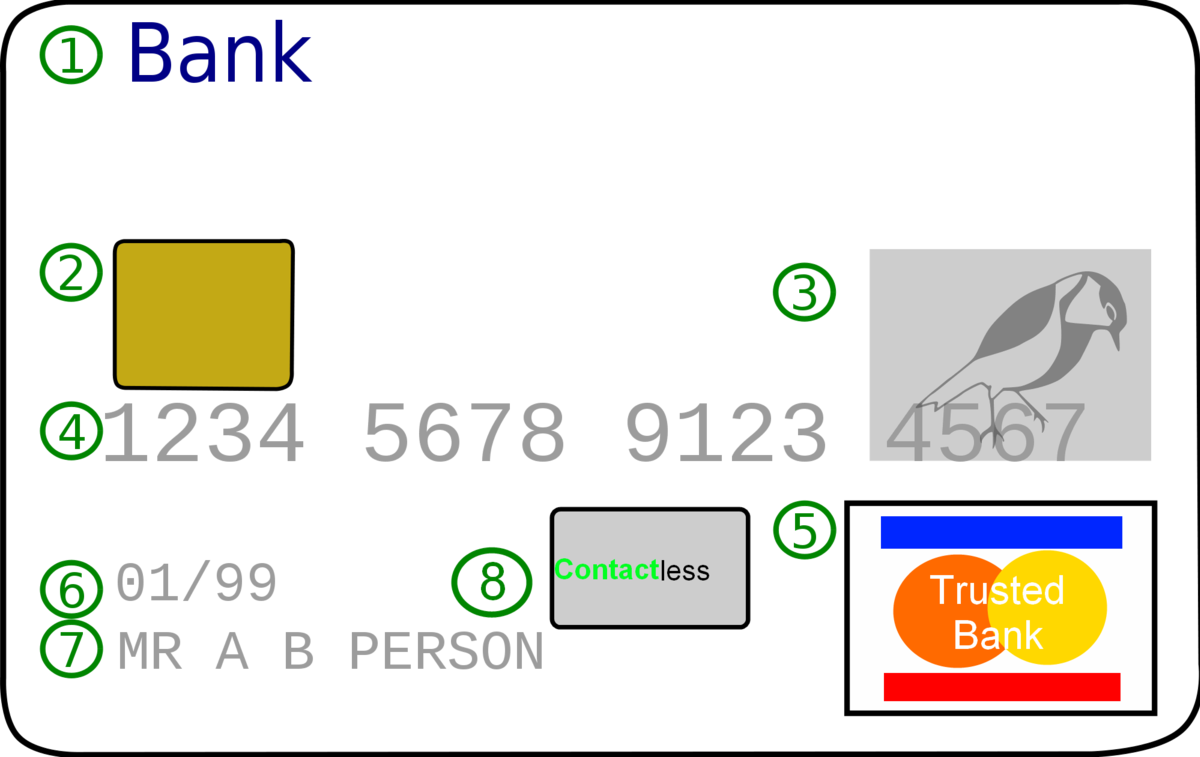

Credit card generators are software tools or online platforms that create seemingly valid credit card numbers. These numbers can closely resemble real credit card numbers, with correct prefixes and checksum algorithms, making them difficult to distinguish from genuine cards. These generators exploit the structure and algorithms used to validate credit card numbers by producing numbers that pass basic validation checks.

Risks and Dangers:

- Fraudulent Transactions: Cybercriminals use these generated credit card numbers to make unauthorized transactions. They can initiate online purchases, subscriptions, or even fund transfers, causing financial losses to both consumers and businesses.

- Identity Theft: Some credit card generators also produce cardholder names, expiration dates, and CVV codes. When combined with other personal information, this data can be used for identity theft and further fraud.

- Legal Consequences: Using credit card generators for fraudulent activities is illegal and can lead to severe legal consequences if caught. Both the generator users and the individuals behind the generator platforms can face criminal charges.

- Reputation Damage: Businesses that fall victim to transactions made with generated credit card numbers can suffer reputational damage. Customers may lose trust in a company’s ability to secure their financial data.

- Losses for Merchants: Merchants accepting transactions that later turn out to be fraudulent can face financial losses due to chargebacks. They may need to refund the amount, pay chargeback fees, and deal with the administrative hassle.

Protecting Yourself:

- Regularly Check Statements: Review your credit card statements and transactions regularly. Report any unauthorized or suspicious activities to your bank or credit card provider immediately.

- Secure Online Practices: Only make online transactions on reputable and secure websites. Look for “https” in the website’s URL and use secure payment gateways.

- Keep Information Private: Never share your credit card information, CVV code, or PIN with anyone. Be cautious about sharing personal details online.

- Use Two-Factor Authentication: Whenever possible, enable two-factor authentication for your online accounts. This adds an extra layer of security.

- Updated Security Software: Ensure your devices have up-to-date antivirus and anti-malware software to prevent malware infections.

Conclusion:

Risks of credit card generators pose a significant threat to individuals, businesses, and the overall security of financial transactions. However, staying informed about these risks and adopting robust security measures is essential to protect yourself and your financial assets. Furthermore, by understanding the dangers associated with credit card generators and staying vigilant, you can stay one step ahead of cybercriminals and maintain a safer online presence